Anne Paxton

December 2014—Like sailing ships, laboratories hope for fair winds as they chart their business plans. But smooth sailing is never a sure bet; rough sea conditions are an ever-present possibility that can make ships hard to steer. Perhaps the tide is with the vessel but the winds are against it. That’s a situation that could aptly describe a health care system facing a growing patient population at the same time that hospital admissions and reimbursement are in decline.

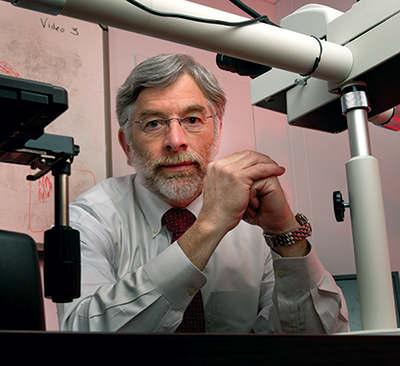

John Waugh forecasts constrained instrument spending for Henry Ford’s laboratories but is planning to make targeted investments. “We just have to keep demonstrating our value for the organizations we support,” he says.

Dwight Cendrowski Photography

For those at the laboratory helm, forecasting test volume and instrument needs under such conditions can be tricky—especially when an entirely new adverse weather pattern could suddenly come out of nowhere. Should the laboratory forge ahead with instrument purchases, pare back purchasing, or wait for conditions to improve? During interviews with CAP TODAY, leading U.S. laboratory executives in four different time zones describe what’s on their instrument wish lists and the mix of forces in 2015 that will be driving their decisions about purchasing.

Some laboratories looking ahead to 2015 say that expansion tops their agenda and it’s just a question of which instruments to go after first. At Pathology Associates Medical Laboratory in Spokane, Wash., for example, the game plan is to expand its National Esoteric Testing Laboratory, says PAML vice president Gregory Clark, PhD.

Hired three years ago, Dr. Clark recently took on the task of managing PAML’s esoteric testing program and enlarging its national footprint. The laboratory’s volume has been steadily increasing and took a jump in the last year. “We’ve seen some sizable test volume gains throughout the last six to 18 months,” he says.

Building a national reference lab has always been a key part of PAML’s strategy. “We want to offer truly state-of-the-art reference testing to our clients—both the joint ventures around the country with which PAML is allied and local physicians and hospitals,” Dr. Clark says.

Dr. Clark

A recent reconfiguration has given the laboratory room to make its move: The information technology department relocated from the laboratory’s building to a general administrative office, freeing up about 15,000 square feet. “We intend to use that space to expand our test menu and to decrease the work we’re sending out to our reference laboratories. If we can do the testing without that additional hop to another lab, it decreases our cost and improves the service we provide.”

Included in the enlarged space will be a new department called “separation science,” which will cover tests like atomic absorption and liquid chromatography, as well as the clinical toxicology work done using the tandem mass spectrometer and HPLC (high-performance liquid chromatography) and GC-MS (gas chromatography-mass spectrometry). The expansion will increase the laboratory’s testing by between 12 and 20 percent, he estimates.

Keeping like instruments near each other is one of the goals because it allows more efficient use of staff. “If you have two instruments, each with a capacity of 40 percent, and they’re distant from each other,” that’s one thing, Dr. Clark points out. “When you have the two instruments together, you can take pretty good advantage of those 40 percent chunks.”

He expects that the Affordable Care Act, with more people entering health plans, will lead to increased testing volume (though not more revenue per test), and that was one of the drivers for PAML to reorganize. “Having systems ‘leaned out’ definitely helps facilitate expansion,” he says, and it’s also happening in the laboratory’s special chemistry area. “We’re moving our random-access, multi-channel instruments from special immunology down to immunohistochemistry, and we’re attempting to ‘lean out’ those processes.”

They evaluate their existing testing platforms to continually improve them. Automation is where they often turn as a means to improve testing performance. They just bought two DiaSorin Liaison XLs, for example, to advance to the next generation of DiaSorin’s immunoassay testing.

Overall, Dr. Clark is optimistic about future growth. “We have a very high value proposition that our customers appreciate, and I think just our organic growth will continue to be strong. If the ACA stays as it is, we will continue to see additional test growth from that, and that’s why we are trying very hard to get the laboratory ready for it.” The competition will always be out there, he says, so it’s critical for laboratories to create synergies within their testing areas to maximize their expertise and resources.

Optimizing testing while leveraging the power of data analytics is the order of the day at TriCore Reference Laboratories in Albuquerque, says Bill Remillard, TriCore chief technical officer. The largest medical laboratory in New Mexico, TriCore was created in 1998 as a reference lab to support the University of New Mexico Hospital Center and Presbyterian Hospital system, which together have 10 hospitals. The UNM and Presbyterian coverage along with branch labs, patient collection centers, and phlebotomists throughout New Mexico provide TriCore with a “unique presence as a sort of Switzerland of lab services within New Mexico,” Remillard says. “This allows clinicians practicing within the state access to longitudinal lab information reaching back to 1998.”

TriCore maintained a good growth rate of five to eight percent even through the 2008–2011 recession, but it is planning conservatively for a rate more in the three percent range, corresponding to the hospitals’ projected growth rate in admissions. “Rather than business as usual, our strategy is really appropriate utilization, so we have a big initiative to optimize testing as part of our TriCore Diagnostic Optimization Initiative.” TriCore is uniquely positioned, he says, to have a significant positive impact on health care costs in a state where savings are desperately needed. “University of New Mexico, Presbyterian hospitals, and our pathologists and physicians are all on board with the optimization goals,” Remillard says.

Remillard

Admissions have been fairly flat, though they are not showing a decline, and Remillard says the laboratory is more in a replacement mode than an expansion mode when it comes to instrumentation. “We have all 10 of our hospitals standardized in chemistry, hematology, coagulation, and blood banking. But since some contracts are expiring, we’re planning an RFP for our coagulation and blood banking instruments.”

Neither outreach testing (about 30 percent of current testing volume) nor anatomic pathology is likely to increase in the short term, he predicts. However, his lab plans to do more next-generation sequencing. “We did purchase our first next-generation sequencing instrument last year, and we’ve developed enough assays on that to buy a second instrument. That additional sequencer will let us develop more testing where it makes sense and also meet the requirement for redundancy”—which gets more urgent as a first instrument approaches a certain percentage of capacity. Many other molecular labs are making the same move, he says. “The price point is reasonable. You can get a good next-generation instrument for less than $100,000, and I think the technology and the effort required to get it up and running is becoming more mainstream than it was just a couple of years ago.”

TriCore has a comprehensive molecular diagnostics area covering oncology, genetics, and infectious disease. In addition, TriCore benefits from an active clinical and device trials relationship with the majority of laboratory vendors, Remillard says, “providing this clinical lab with a first look at many new instruments destined for availability in the U.S.”

He sees a potential obstacle in the FDA’s impending regulation of laboratory-developed tests. “We have more than 150 LDTs throughout our laboratory, probably 60 percent of them in molecular. It’s also clear that LDT oversight by the FDA will add significant effort and expense, especially with the clinical validation piece.”

That’s a cost that has to be factored in when laboratories are deciding whether to make or buy, Remillard says. “Many esoteric reference laboratories have developed spreadsheets assisting with make-versus-buy decisions, and FDA regulation of LDTs just adds a new level of complexity to that. It could be it ends up taking some labs out of the market for certain tests.”

“There’s a lot of great technology out there, but all of us in the esoteric space need to go in with our eyes wide open with respect to the regulatory challenges we will be facing if it is not an FDA-approved system,” he warns. “There could be a lot of surprised people out there who may have to either invest a lot of money to get approval or stop using a particular system.”

TriCore is planning to acquire additional instruments in a lot of areas such as toxicology, where more tandem mass spectrometers will be purchased to handle growth. “That’s been an excellent tool for pain management testing,” Remillard says. Because of the high street value of prescription pain drugs like Oxycontin, pain management testing is often recommended—and in some states, mandated—to ensure the patient is taking the drug as prescribed and not self-medicating with other drugs. “The tandem mass spectrometers are also tremendous tools for hormone, vitamin, and steroid analysis,” Remillard says.

John Waugh with Ruth Doubleday, lab systems analyst. and Ralph Benitez, supervisor of lab support services. Laboratories continue to get disproportionately hit by reimbursement cuts, Waugh says, because they are more of a “back of the house” function.

TriCore has already embraced automation and plans to install more of it, he says. “We have a significant amount of automation in hematology where we have a fully automated system from sample loading to slide making/staining and image capture and analysis. We also have a large-capacity chemistry-immunoassay automated line to include decapping and sample storage.” One of next year’s initiatives is to begin stepping up microbiology automation. “Like many larger facilities, we have automated blood cultures, and we did bring in the MALDI-TOF for microbiology identification. Microbiology will be a growth area for TriCore, primarily due to the success of centralizing microbiology for all sponsor hospitals.”

The pitfall of automation is that it involves fairly significant capital purchases, and Remillard is not sure how much more the laboratory can afford to take on in 2015. “It takes a few years to optimize how you’re using the automation, so I’d never recommend trying to automate multiple areas at the same time.” The laboratory recently implemented a sample delivery robot and is looking at sample sorting and sample aliquoting as well, but possibly not in the next year.

Unfortunately, his department, technical operations, has a certain level of friendly competition with information technology for funds. “More money for IT is on the budget radar. I can’t give you numbers, but it’s always technical operations and IT that like to spend the most money, and this year I think IT wins.”

The national movement of patients from the inpatient side to the outpatient side is driving the roughly four percent decline in test volume year over year, says John Waugh, vice president, System Laboratories, Henry Ford Health System, Detroit, one of the largest integrated delivery networks in the country and manager of 3 million patients. Countering that push is a population that continues to age and have greater health care needs. “So that’s an offset, in particular because a lot of our lab testing supports chronic disease management,” Waugh says.

Still, within that environment, he forecasts constrained spending on instruments in the near future at Henry Ford. Cuts in reimbursement are a train that can’t be stopped, he says, and laboratories continue to get disproportionately hit because they are more of a “back of the house” function. “If you announced that the Medicare system would reduce the number of nurses or doctors or availability of medication, there would be such a social outcry that it would be all over the front pages. But here there’s more of an occult attack on health care reimbursement that is specifically targeting labs, and it will constrain our budget going forward. So we have to shift to more of a cost-containment mode.”

The single- and double-digit growth of certain sectors of clinical laboratory diagnostics has abated significantly, Waugh notes. But integrated delivery networks like Henry Ford continue to see growth as they acquire new hospitals through consolidation, and instruments and IT need to be purchased to standardize across the system.

In hematology, chemistry, and coagulation, his laboratories plan to make targeted investments in automation to improve workflow, shorten turnaround time, and compensate for the dwindling medical technologist workforce. With more testing coming to the core lab, he thinks Henry Ford will be able to justify automation investment in serology as well as microbiology. “We have MALDI-TOF systems in place right now and multiple workstations associated with them, plus an automated microbiology plating system.”

One category of purchasing will always be there and he refers to it as “keep the lights on”—the purchase of items like centrifuges and freezers that the laboratory relies on. In addition, a lot of capital dollars are being allocated to meet meaningful use requirements and to strengthen decision support.

But outside those expenditures, capital capabilities at his system are not very robust, Waugh says. “We just have to keep demonstrating our value for the organizations we support, be very savvy about where we’re making our investment, and try to leverage our value for the company.”

In New Orleans, the Ochsner Clinic Foundation has pegged its growth on expansion. After growing rapidly in the past few years by purchasing some hospitals and setting up partnerships or affiliations with others, Ochsner is now the largest integrated delivery network in Louisiana, says Gregory Sossaman, MD, system chair, pathology and laboratory medicine. That’s allowed test volume to continue to climb even as hospital admissions have declined.

Dr. Sossaman

In fact, it has created a geographic problem for the core laboratory. “We’re located within our tertiary care hospital and there is no more space,” Dr. Sossaman says. The system is planning to find more space off site, probably at a location within 10 or 15 miles and centrally located within the system’s coverage area.

When the Ochsner Clinic Foundation acquires hospitals, generally the acquisitions don’t include instruments, but that doesn’t necessarily mean new instrument purchases are in the offing, Dr. Sossaman notes. “We try to standardize as soon as it fiscally makes sense if a contract is up or if we can leverage our volume to get the hospitals a better price.”

“Most of the smaller hospitals are not flush with capital, so buying a new $200,000 chemistry instrument doesn’t make sense when they have one that is a couple of years old.” The Ochsner system is now in the midst of a microbiology consolidation project involving several hospitals in the system, but not all partners will join in that because the acquisition arrangements of each contract vary.

At one point, Ochsner had a strategic initiative to replace many instruments across the system. “That was to standardize and replace as much equipment as we could. We had a pool of capital we utilized over a one-year period after we acquired each new facility; after that, it is up to that facility to come up to standard at its own expense. If they have a piece of equipment that’s 10 years old, they’re going to adopt our standard. But in the end, it may make sense for them to switch anyway, because our volume will let them save so much money for reagents and supplies on an ongoing basis.”

The core lab brought in new MALDI-TOF instrumentation just a couple of months ago, but more hardware is likely to be purchased in the next year, including an automated molecular testing instrument, as well as another MALDI. In 2016, he says, the system may be looking to add one of the automated WASP streaker/platers and front-end automation for microbiology.

The percentage of system expenditures going to the laboratory is holding relatively steady, Dr. Sossaman says. “Despite there being cuts in reimbursement for certain tests, if you look at where there is still a pretty good margin overall, some hospital labs continue to see good margins. And health systems usually continue to invest in areas where they have healthy margins.”

“As far as instrumentation, I think lab budgets will continue to hold steady as long as those areas continue to be profitable. As the core lab takes on more work due to consolidation, our spending in areas like histology and microbiology has gone up, because you have to keep investing in those services.”

He thinks health system executives are going to continue to focus on value when considering instrument requests. “‘Value’ is a big buzzword, but they’ll focus on adding value to the overall system, and in many cases they are going to need to look for newer technology like mass spectrometry.” One of the justifications for acquiring the MALDI was not only that it was cost-efficient for the laboratory but also that it brought savings to the hospital system by reducing length of stay.

“So we’ll continue to invest in standardized equipment, but we’re now moving beyond that to looking at savings or cost avoidance for the whole system. Looking more outside the lab is a very different approach, and those justifications are much harder to do. But that’s where the bigger opportunities lie.” Luckily, Dr. Sossaman says, that message is one that executives with his system are hearing and taking seriously.

Despite the national figures on falling admissions, the volume that Memorial Hermann Healthcare System in Houston has been witnessing has been robust, says Richard Brown, MD, medical director, System Laboratory Services. Memorial Hermann, with nine hospitals, is the largest nonprofit health system in Houston and has been growing steadily, continually adding new facilities as the demographics change, Dr. Brown says.

Dr. Brown

“Our strategy recently has been to open three convenient care centers where basically patients can get the equivalent of an ED visit with hematology, chemistry, radiology, and other services on site, while the higher-end testing—anatomic, molecular, and high-end immunology—are done at the core lab facility.” The core laboratory performs 9 million tests per year, and with the convenient care centers plus the system’s outreach program, “our volumes will continue to grow in 2015,” he projects.

He has two major goals for equipment purchases in the short term: to reduce turnaround time, particularly for higher-end tests like molecular, and to use staff more effectively. Memorial Hermann uses a combination of purchase agreements and reagent rental agreements when issuing RFPs for acquiring instruments. “Our philosophy is if the technology is changing rapidly, we’re more likely to go with a reagent rental agreement rather than buy the equipment when we would be holding on to equipment that is no longer state of the art.”

Speaking generally, Dr. Brown says, there is a breakpoint for every system where the number of specimens you manage every hour becomes more than you can effectively manage with people. “We’ve crossed that threshold. The laboratory is now a mature entity, and there are significant time savings to be had by automating the front end.” So the system is now looking actively at automating front-end chemistry, immunology, and microbiology.

The other area the laboratory is most interested in is molecular testing. “We are still a very traditional molecular laboratory. We predominantly do batch testing for infectious disease, with straightforward PCR reactions on typical extraction and amplifying equipment.” Now the laboratory hopes to move to new platforms allowing for multiplexing and random access and for detection of respiratory or gastrointestinal pathogens at the same time in the same tube.

Reducing turnaround time for molecular will reap benefits in terms of resource utilization. “For patients put in isolation for MRSA or C. difficile, we are using resources like crazy until they get a negative test result. The faster we can provide that negative result, the better.” The same is true for ED patients waiting to get results on a viral test. “The new paradigm,” Dr. Brown says, “is not how many minutes it takes to get a chemistry test through the laboratory; it’s about having an impact on patient flow in and out of the hospital.” MALDI-TOF, which is also now being implemented at Memorial Hermann, is the same: It can rapidly identify organisms, get the patient on the right antibiotic therapy, and get the patient out of the hospital quicker.

Both molecular and MALDI-TOF are expensive, he concedes. “That’s an obstacle to implementation relative to standard batch testing or standard culture and sensitivity. But once you get beyond the laboratory budget and look toward the big picture, you can justify those kinds of expenditures.”

In fact, MALDI-TOF will be the target of the hospital’s first analysis to demonstrate that faster testing coupled with the antibiotic stewardship program can show a demonstrable return on investment. “The MALDI will be our first large, interdisciplinary analysis of the overall cost savings achieved by shortening time to appropriate antibiotic therapy and length of stay,” Dr. Brown says.

Another payoff of more front-end automation, he forecasts, is that it will ease the laboratory’s ability to cope with expected increases in outreach testing. “We have plenty of testing capability. The analyzers are fast. But getting the specimens, processing them, and getting them ready for the analyzers—that’s where our bottlenecks are.” The moral: “Wherever you can use automated technologies, particularly front-end processing, to free up personnel to do other things, that really is where the largest productivity gains are to be had these days.”

How is the laboratory faring in competition with other departments for health system resources? It’s true that everything is getting tighter because the total number of dollars going into the health care system is declining, says Dr. Brown. “But I think we’re holding our own. I don’t think we’ve had any instances where we were not able to acquire something important.”

However, as he notes, the system’s fairly broad use of reagent rental contracts rather than outright purchase gives the laboratory a leg up in the competition with other departments. “When you’re not talking about purchasing instruments for $100,000, $500,000, or $1 million, it’s much easier to make your case.”

As Dr. Brown and most of the other laboratory leaders interviewed suggest, while there are challenges ahead, laboratories will start 2015 in a good position to prove their value to the bottom lines of health systems, and they may also have success in showing that acquiring new instruments and other technology could boost that value even further.

[hr]

Anne Paxton is a writer in Seattle.

![]()